We continually monitor, analyze and seek to minimize the risks within our capital structure with a view to maintaining an optimal financing mix that suits the nature of our businesses and that generates value for shareholders.

Our team is squarely focused on meeting – and exceeding – planned business performance expectations, which improves our company’s stability, value and future prospects.

We seek to manage our capital structure so that it remains flexible and offers room for expansion.

Our debt to capitalization ratio at year end, which is appropriate for the low risk profile and long life of our businesses.

Our debt to capitalization ratio at year end, which is appropriate for the low risk profile and long life of our businesses.

Dear Fellow Shareholders,

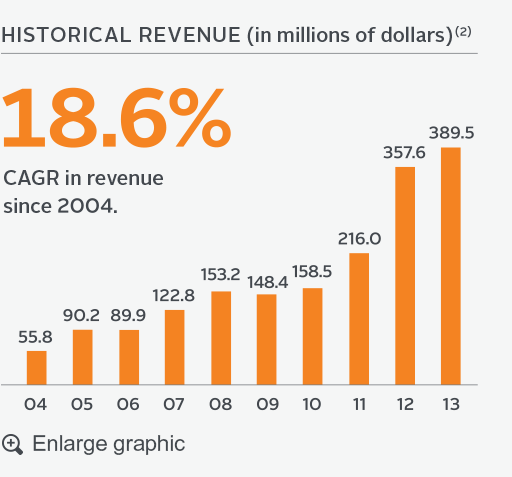

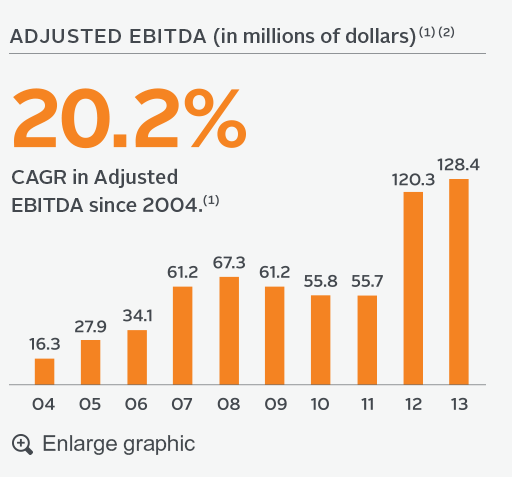

Fiscal 2013 represented a year of solid execution and growth in many aspects of our business. Total revenue grew by 8.9%. Our Adjusted EBITDA grew by 6.7% to $128.4 million, which was in line with our updated expectations and reflected the diverse mix and stable cash flow characteristics of our infrastructure businesses.

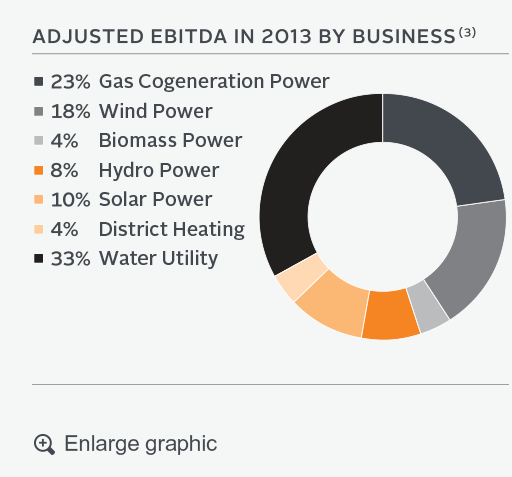

We accomplished this performance while completing the acquisition of Renewable Energy Developers Inc. in early October, adding new talent, several operating wind facilities, and a pipeline of wind power development projects to our portfolio. This transaction will contribute to Capstone’s performance in 2014 and beyond, particularly as the development projects are completed, and provides us with a larger platform for growth.

The low variability of our results from year to year speaks to the long-term stability of our portfolio as well as our solid financial position. We ended 2013 with a debt-to-capitalization ratio of 65.7%, reflecting an increase in debt at Bristol Water to fund ongoing capital expenditures and the input of foreign exchange translation. We ended the year with cash of $45.8 million, of which $18.5 million is available to Capstone for general corporate purposes. The variance between this position and the cash available at the end of the third quarter was primarily due to the cash used at Bristol Water to fund its capital expenditure program. Notably, our outstanding debt is almost entirely fixed rate or linked to inflation and is predominantly secured at the operating business level, which means it is non-recourse to Capstone. Approximately 97% of the long-term debt at our power facilities is scheduled to amortize over our PPA terms. At Bristol Water, approximately 80% of long-term debt has a maturity longer than 10 years. Our capital structure at the corporate and subsidiary level aligns with the cash flow profile and duration of our businesses and gives us the flexibility to pursue new investments.

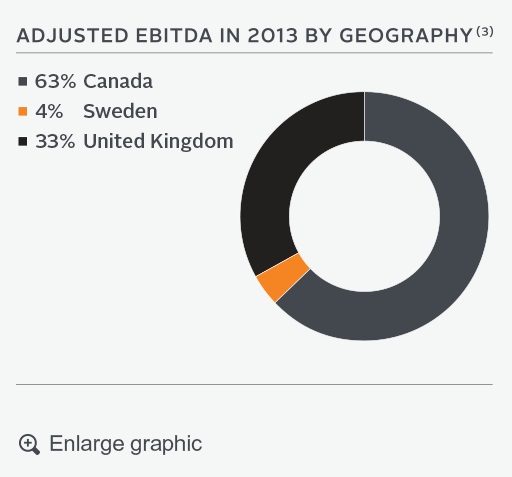

Our corporate strategy is to develop, acquire and manage a high quality portfolio of infrastructure businesses across four pillars of core infrastructure: utilities, power, transportation and public-private partnerships. In each of these segments, we look for long-life businesses that are contractually defined or regulated, and which provide stable, predictable and growing cash flows.

A key priority of my job is to direct capital management planning to make sure we have the resources to support growth, including:

- Ensuring an appropriate capital structure at the corporate and subsidiary level that aligns with the cash flow profile and duration of our businesses;

- Preserving our financial flexibility to ensure access to either debt or equity capital on commercially reasonable terms;

- Maintaining sufficient liquidity to meet short- and medium-term operating needs;

- Establishing relationships with investors and lenders to enhance our capacity to seize growth opportunities as they arise; and

- Communicating Capstone’s operating results and performance expectations with transparency.

A specific focus in 2014 will be to arrange approximately $140 million in project-level financing for our near-term wind development projects, which include Skyway 8, Saint-Philémon and Goulais. In addition, we recently established a new $50 million corporate credit facility to provide us with flexibility to advance our development projects and to pursue other growth initiatives.

For 2014, we expect to achieve Adjusted EBITDA of $140 million to $150 million. This reflects our expectation of continuing stable performance from our power and utilities businesses, including a full year of contribution from the operating wind facilities we acquired from ReD and a partial year of contribution from our development projects as they enter commercial operations. We are focused on efficiently managing and building our businesses, improving our practices and operations wherever possible, and continuing to pursue growth opportunities that will build shareholder value. I believe 2014 will prove to be another active year for Capstone.

A key strength for our company is the quality of our people at all levels of the organization and the deep relationships they have cultivated with suppliers, customers, landowners and local communities, which enhances our competitive position and fulfills our responsibility to stakeholders. This team works hard to support Capstone’s mission, which is to provide investors with an attractive total return from responsibly managed long-term investments in core infrastructure in Canada and internationally. We are also committed to providing fair and transparent disclosure about our business and performance to the investment community and other stakeholders. The Chartered Public Accountants of Canada recognized our efforts in 2013 with an Award of Excellence in Corporate Reporting.

Capstone’s fundamentals remain strong. The investments we have made over the past few years are paying off in terms of our businesses and financial metrics, and our portfolio features increasingly diversified and high quality income streams. We believe our disciplined, prudent approach to financial management and growth will enable us to continue to create value for our shareholders.

Thank you for your continuing support.

Sincerely,

Michael Smerdon

Executive Vice President and Chief Financial Officer